However, managing your business finances correctly doesn’t always come naturally—especially if you’re not much of a numbers person. What’s more, accounting for construction company finances has some unique challenges compared to other types of businesses. Using the principles of accrual accounting, percentage of completion and the completed contract method are both heavily utilized within the construction industry. Below we’ll take a look at what to keep in mind for both when structuring your chart of accounts.

Revenue

However, the nature of construction companies makes how these businesses recognize revenue more complicated. Job costing is a method for allocating expenses and revenue to each specific job. Not only will this help you prepare for tax time, but it provides an accurate accounting of profitability for each contract. Your company may manage short- and long-term contracts, often with varying end dates.

To stay on top of cash flow and keep your books in check, you will need a flexible yet organized construction accounting system. The COA should be designed to comply with industry standards and regulations, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Additionally, construction companies must be mindful of specific regulations related to contract accounting, revenue recognition, and cost allocation. Ensuring that the COA is compliant with these standards is critical to avoiding financial discrepancies and potential legal issues.

Why Certificates of Insurance (COIs) Are Essential for Protecting Your Construction Business

- A carelessly designed COA fails to provide visibility into all the accounts and transactions, a well-designed COA can drive real business benefits.

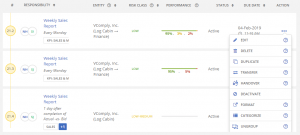

- Knowify and its integration with QuickBooks Online helps construction contractors create and use a chart of accounts by automatically synchronizing data between Knowify and QuickBooks Online.

- This not only improves the precision of financial evaluations, but also aids in better decision-making and project management by offering a transparent and comparable financial overview.

- Luckily, modern accounting software makes life easier for accountants by automatically labeling and categorizing the entries, which makes them easier to track and locate.

- Overhead or operating expenses are the day-to-day expenses of running your business.

As a construction company, you may have multiple owners, each with a different percentage of ownership. It’s important to keep track of each owner’s equity separately, as this will affect their share of any profits or losses. Our team of experts understands the unique challenges of the construction industry. Contact us today for a free consultation and take the shareholders equity formula first step toward optimizing your financial management. Crafting a Chart of Accounts tailored for construction not only enhances financial clarity but also aids in strategic decision-making.

Confidently build your business with organized projects that stay on-budget

A chart what is a chart of accounts a small business bookkeeping guide of accounts, or COA, is a listing of all the financial accounts in a construction company’s general ledger (GL). Accounts are grouped into categories that correspond to the structure of a company’s financial statements. The chart is formed by a list of numbered accounts with the account names and their brief descriptions. Consider the cost of insurance, travel, workers’ compensation, materials, subcontractors, equipment, and more. You will need to factor this into your construction accounting for each construction project and for the business as a whole.

To facilitate meaningful comparisons and reporting, it’s important to maintain consistency in the COA across all projects. This means using the same account structure and coding system for every project, regardless of size or scope. Consistency helps ensure that financial reports are accurate and comparable, making it easier to analyze performance and identify trends. If you’re looking to revamp your chart of accounts, consult with your accountant about the best time to do it.

These correcting transactions are called journal entries and require the same double-entry method as any other transaction. Transactions from accounts payable, accounts receivable, and payroll affect the prepaid expenses examples accounting for a prepaid expense general ledger as they are entered into the accounting system. As mentioned above, each transaction affects at least two accounts and is balanced in its debits and credits. This activity feeds the general ledger accounts as each transaction is processed. Use this sample chart of accounts as a starting point, and ten customize it to fit the unique needs of your construction business. By properly implementing and managing your chart of accounts, you can set your business up for long-term success.

In the construction industry, the Chart of Accounts (COA) must be tailored to meet the unique requirements of the industry, like monitoring expenses by project, stage, and type. Unlike many other industries, construction requires a more granular approach to account management to capture the various elements of each project. This often involves using subaccounts and segmentation to reflect the different stages and types of work involved in construction projects. However, it is important to use subaccounts in moderation, if not avoid them entirely, to maintain clarity and simplicity in the COA.

A carelessly designed COA fails to provide visibility into all the accounts and transactions, a well-designed COA can drive real business benefits. Unlike overhead expenses, operating expenses result from the normal operations of your construction or service business. Any expense that keeps the business running, beyond direct materials and labor, falls into this group. Operating expenses in the construction industry include rent, wages, utilities, administration expenses, maintenance, and repairs, among others. As you start to build your COA, consider using the following standard accounts and expenses.